Main Business

With thirty years of expertise and experience, we are dedicated to create a better financial future for our clients.

- Development and management of fund products

- Developing fund products based on current market conditions and clients needs

- Managing various types of fund assets, such as equity-type, balanced-type,

bond-type, MMFs, derivatives, ETFs, annuities, workers’ investment funds,

special assets, real estate, and SOCs.

- Discretionary investment management and advisory services

- Custom-tailored discretionary investment management for institutional investors

- Investment advice provided by Korea’s leading industry specialists

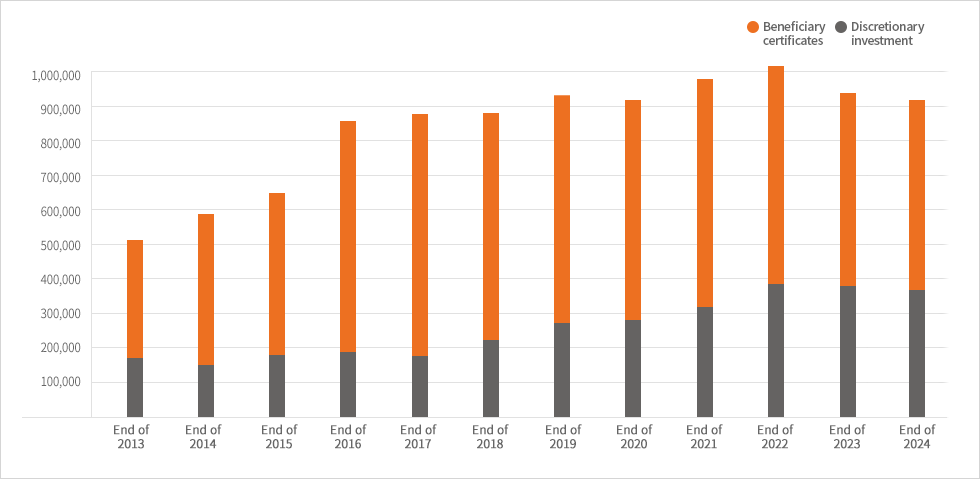

Invested assets

Unit: KRW100 million

| Classifications | End of 2012 |

End of 2013 |

End of 2014 |

End of 2015 |

End of 2016 |

End of 2017 |

End of 2018 |

End of 2019 |

End of 2020 |

End of 2021 |

End of 2022 |

End of 2023 |

End of 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total | 361,403 | 523,468 | 598,611 | 663,791 | 861,453 | 876,601 | 896,684 | 930,629 | 918,855 | 990,906 | 1,060,717 | 940,441 | 912,447 |

| Beneficiary certificates |

171,430 | 174,764 | 163,563 | 185,071 | 187,087 | 195,797 | 232,757 | 282,225 | 292,759 | 340,935 | 382,410 | 388,418 | 372,476 |

| Discretionary investment |

189,973 | 348,704 | 435,048 | 478,722 | 674,367 | 680,804 | 663,927 | 648,404 | 626,096 | 649,971 | 678,308 | 552,024 | 539,971 |

Source : Korea Financial Investment Association